florida estate tax exemption 2021

That means that due to this increased estate tax. No Florida estate tax is due for decedents who died on or after January 1 2005.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Ad FL DR-309631 More Fillable Forms Register and Subscribe Now.

. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Its offered based on your homes assessed value and provides. With the Florida homestead exemption you can reduce the taxable value of your home by as much as 50000.

Proposal 1 A reduction in exemptions. As of January 1 2021 the federal estate tax exemption amount increased to 1170 million up from 1158 million in 2020. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021.

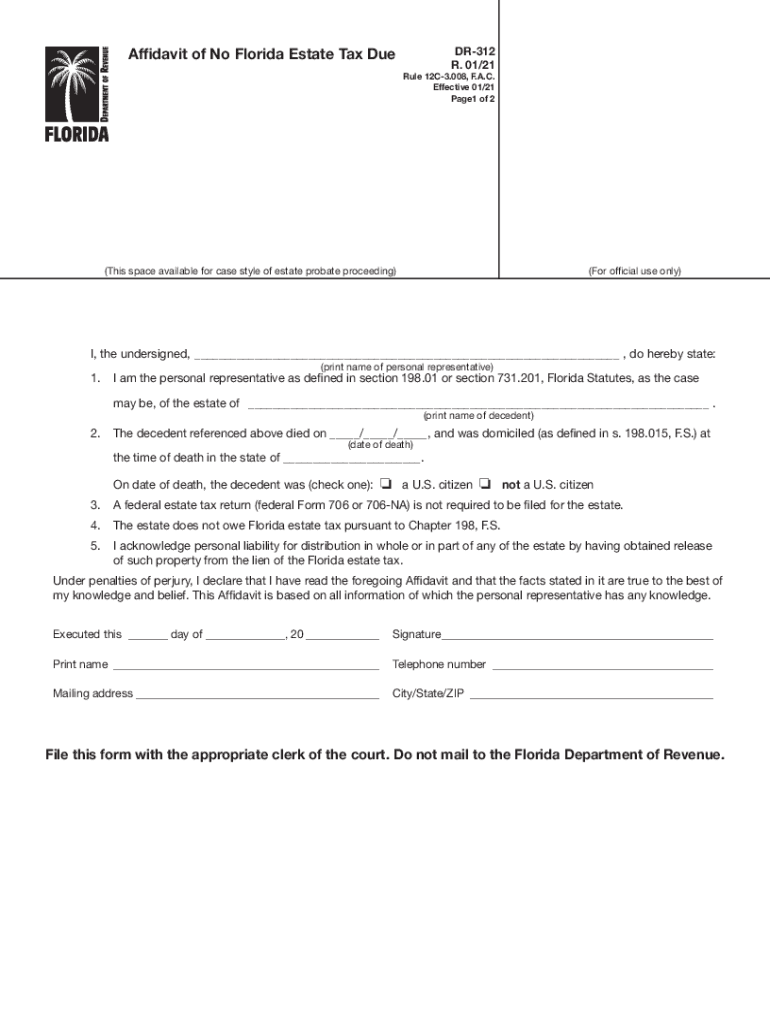

The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022. Florida Estate Tax Rules On Estate Inheritance Taxes Fl Dor Dr 312 2021 2022 Fill Out Tax Template Online. Florida estate tax exemption 2021.

Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it. Estates of Decedents who died on or after January 1 2005. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. If youre a Florida resident and the total. Floridas 2021 Homestead Tax Exemptions.

As a result of recent tax law changes only those who die in 2019 with estates equal to or greater than 114 million must pay the federal estate tax. Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer. 2022 Annual Gift Tax Exclusion - increased to 16000 from 15000.

The amount of the estate tax exemption for 2022. Starting in 2022 the exclusion amount will increase annually based. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Florida estate planning lawyers help people develop a family or business-friendly strategy to maximize tax savings tax cuts. Good news but makes it a little harder to do the math for mutliple gifts in your head. But once you begin providing gifts worth.

Buyers if you bought your home in 2021 have you filed for Homestead Exemption yet. Federal Estate Tax. The Form 706-NA United States Estate and Generation-Skipping Transfer Tax Return Estate of nonresident not a citizen of the United States if required must be filed within.

Ad Download Or Email Form DR-312 More Fillable Forms Register and Subscribe Now. 2021 Florida Sales Tax Commercial Rent December 30 2020. What this means is that estates worth less than 117 million wont pay any federal estate taxes at all.

Together a married couple can shelter up to 234 million under. This year the estate tax exemption in 2021 is increasing to 117M. Florida estate tax exemption 2021 Thursday March 10 2022 Edit.

Currently the estate tax exemption amount for 2021 is 1170000000 per individual 2340000000 for married couples who use their estate tax credit when they die. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. The estate tax exemption in 2020 was 1158M.

The current federal tax exemptions are at 117 million in 2021. The estate tax exemption in 2022 is approximately 12000000. An individuals leftover estate tax exemption may be transferred to the surviving spouse after the first.

If the estate is not required to file. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. Presently the tax exemptions are set at 11700000 per person an increase from 2020s exemption of 11580000.

November 28 2021 alison brie dave franco. When someone owns property and makes it his or her permanent residence or the permanent. Citizen may exempt during his life or after death this amount of assets from estate taxation.

Increasing Estate Tax Exemption In 2022

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Fl Dor Dr 312 2021 2022 Fill Out Tax Template Online Us Legal Forms

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

U S Estate Tax For Canadians Manulife Investment Management

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

2022 Irs Cost Of Living Adjustment Limits Released Boulaygroup Com

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

How Is Tax Liability Calculated Common Tax Questions Answered

![]()

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

Estate Tax Planning And Using A B Trusts For High Net Worth Estates Estate Planning Attorney Gibbs Law Fort Myers Fl

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

Florida Property Tax H R Block

Florida Estate Tax Rules On Estate Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax In Florida Legal Guide For 2022 Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die